Best Movies about Money, Finance, and Wall Street: Money is the rudimentary building block of society. The world works because of it. And quite strangely, for it as well. It is the one constant in life that will never change or get old. It is also the one true determinant of how society perceives you. Those almost weightless pieces of paper map out an entire life.

This power of money is the reason why we are taught about its value from such an early age. Learning how to manage, wield, save, and spend it is a basic life skill. That is the reason why finance has become such an expansive subject. Films are an immensely popular platform to talk about it.

Anything that we see and hear gives us far more impetus than just reading about it. You can pick up a book about the 2008 financial crisis in the US but not be as interested in the best seller as you can when watching something like The Big Short. These are just facts.

That is why people who make movies make more money than those who sell books. Unless, of course, you are Stephen King, George Martin, or JK Rowling. Movies about finance are especially exciting for those who are excited by money. Yes, a rare breed of people – like yours truly – do get excited around the subject of finance, not in an ordinary way.

Because seeing money as just something to spend devalues its magic. Movies about finance in our list are not just picked randomly or on merit. We have curated this special piece for you with a specific chronology of how money came into being and how it evolved over so many centuries with evolving sensibilities about the world. They all have the capability to arouse that aficionado in you who sees finance as a passion. There are five sub-categories in our categorization.

Films about financial crises like the 2008 US housing bubble; films about personal finance that boost self-improvement; movies about entrepreneurship; films about everyone’s favorite Wall Street; and finally, films about financial scams. You will find all of this in our list of the best movies about finance.

The Inception of Money and Financial History

Isn’t it fascinating to discover how money came into being and destroyed the modern world? The inception of money and the history of financial systems is not purely an academic domain but definitely heavily leans toward it. Such films and documentaries create an educative framework for you; the narration is the key here, and The Ascent of Money is our most compelling pick from the pack.

The competition is intense with documentaries like The Commanding Heights (2002), Life and Debt (2001), and 97% Owned (2012), all of which map out the journey of money.

1. The Ascent of Money (2008) – The Film about the inception of the money

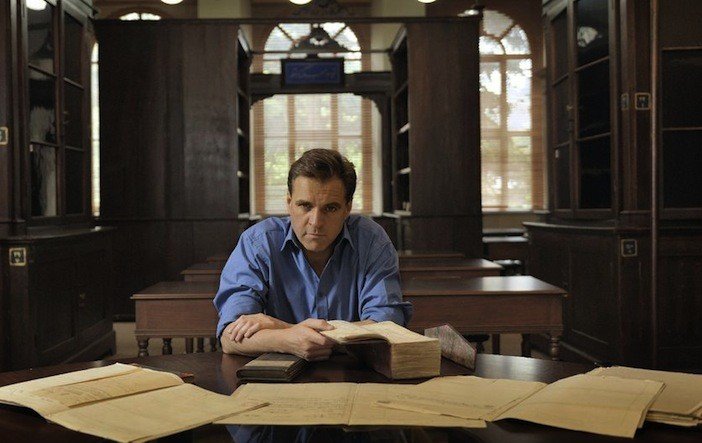

This seven hours long (in its original form) marathon has everything you want to know about money. Like Darwin charted the evolution of man through many shapes, ages, and forms, The Ascent of Money does the same with money. You will be surprised to learn where this concept of giving something for something in return came from. The documentary is based on the 2008 book by then-Harvard professor Niall Ferguson. The most fascinated minds about how this monstrosity of finance started in the world will enjoy The Ascent of Money in its every breathing second. Not only has the documentary explored the genesis of money and finance in its later episodes, but it has also taken a look at how it became a pivotal part of our lives.

Whether we like it or not, our lives are dictated by how much we can earn and how fast. The dependency is so strong that money ends up controlling us in unimaginable ways. The Ascent of Money shows how the ambition to manifest money is “the mirror of mankind.” It captures the totality of man’s savagery and the need to vest power in themselves. Even though no assertions are made, the documentary’s underlying spirit points in that direction.

2. Wall Street (1987) – The First Culmination of Human Greed and The Stock Market

Gordon Gekko’s character changed the perception that many had about the stock market. Wall Street, the film, manifested the fears and hushed opinions they had about the financial edifice in their living rooms. It is also a terrifically acted and well-composed piece of cinema that one can consume without too many hiccups. Despite the presence of finance jargon that the professionals themselves do not understand fully, Wall Street attracts you at a minute level. The viewer’s attention is not drawn to the technical details of insider trading but to something very human that we all can understand and relate to. In Gekko, Bud finds the elusive mirror to his future.

For most, he is an easy reference point. At some point in our lives, we have all gone through the same feelings and emotions. There is no denying the greed that is the underlying highpoint on wall street. It is truly a junkie-like high we feel when we make a successful investment. One can even call it a child-like feeling of experiencing everything fresh. Rewatching, one gets the same sense from Wall Street.

The Rise of Individualism: Films About Personal Finance and Entrepreneurship

The most desired category of financial films is those that are skill accretive for the viewers. Hearing from and learning about the greats who have done it before all on their own arouses special energy and motivation in you. There is no bigger galvanizer than that. The Century o the Self (2002) is an incredible psychoanalytic dive into how governments, corporations, and masses latched onto the idea of finance and money. However, the nuances are a little technical and get dull after a while. A few other names like Capital in the Twenty-First Century (2019), The Laundromat (2016), and The Inventor (2019) are impressive films, but we went with films about Warren Buffet and Ray Kroc.

The biggest name in the investing world is Warren Buffet. There have been a few who have beaten Mr. Buffet in the CAGR race, but his name strikes out because he teaches us the most important virtues to be a responsible and self-sufficient investor: reading, business awareness, discipline, and temperament to handle volatility. Ray Kroc revolutionized the world of fast food by developing the brand McDonald’s to become the world’s premier fast-food chain and so huge that it owns more than 10% of the entire real estate in the world. His unique selling acumen and opportunistic takeover of the franchise have important lessons.

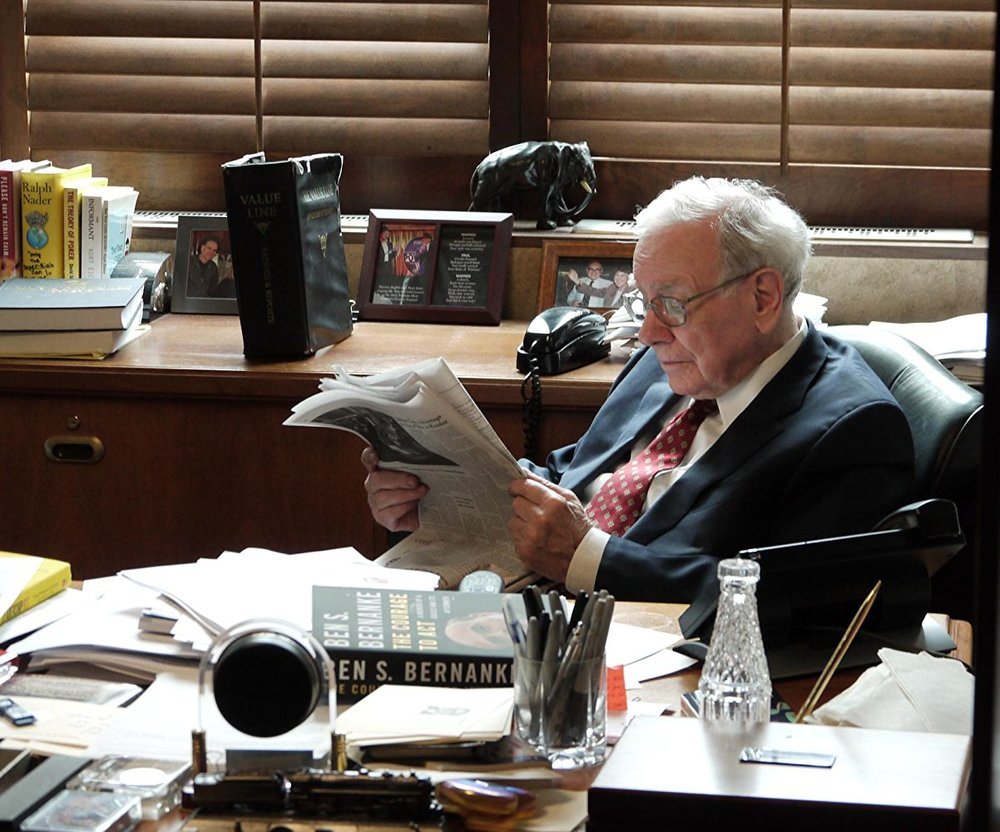

3. Becoming Warren Buffett (2017) – Manifesting the Power of Compounding

Mr. Buffet is an institution in the reckoning of the modern investor. He is singularly the most impressive, humble, and iconic individual in the world of finance. As unwitting and unwilling the labels might be for Mr. Buffet, we all look up to him to see what he did right. A student of Benjamin Graham’s value investing and Phil Fisher’s scuttlebutt, Buffet consistently remained ethical in his dealings, even as he made 99% of his wealth after the age of sixty. When one talks about personal finance, investing in equities is a natural pull. Buffet has demonstrated over the years how, through fiscal discipline, reading annual reports, and tremendous patience, this asset class – otherwise perceived as risky or speculative – can be life-changing.

In this documentary, the makers explore how Buffet transformed himself from an obsessed enthusiast with a keen eye for stocks to the richest equity investor in the world. He talks about the magic of compounding, his investing philosophy, and his happy childhood. Becoming Warren Buffet is not patronizing. Any project that closely follows the great man seems incapable of being that, owing to Buffet’s humble upbringing and deeply grounded demeanor. It is a great place to start your own investing journey. Buffet is the power of compounding epitomized!

4. Maxed Out (2006) – credit card debt; ruining lives

Another gem about personal finance we think you should see is Maxed Out. James Scurlock’s breezy documentary features a host of interviews with vested participants in the financial systems. At the core of the project, he lists out the predatory nature of credit card companies, and how the system lures you into spending money you do not have on things that you do not need. It is a psychological entitlement that you pay for with your life. Even though it is a wholly academic endeavor, Scurlock manages to integrate the essence of what he is trying to say with a flair for drama.

Credit card debt is a huge rider in the lives of the average American people. This prevailing issue is compounded by the exorbitant interest rates on paying late the amount owed and certainly the lackadaisical attitude of people. It has caused a spending spree like modern America has never seen before. The more the consumers are shown the glitz of owning new things, the more they find themselves convinced of the failings of the trap. This film is a must-watch for young people starting their financial journeys.

5. The Founder (2016) – persistence always pays off

After a couple of rewatches, I discovered that watching The Founder without knowing the context or the storyline is a more rewarding exercise than obsessing over what details about Ray Kroc’s life have been reproduced verbatim. There is a beauty to how the first half of the film unravels, filled with opportunity, excitement, and a stout rags-to-riches story. By the end, the mood certainly changes for the worse. But you still leave with inspiration and a renewed sense of ambition about the limitlessness of the world. Michael Keaton is the perfect vessel for John Lee Hancock’s vision of Ray. He purposely leaves the grey areas from his life that might not necessarily give him brownie points in your eyes.

There is no glorification on his part of the man’s stature and influence on the fast-food industry today. But there seems to be a veiled sense of gratitude for the revolution it brought into our lives. From a financial point of view, The Founder advocates entrepreneurship in its natural, cutthroat manner. Success comes at a cost, even at times compelling you to sidestep your moral compass and its projections. It is not all goody-good like pop culture would have us believe otherwise. Ray’s ear for money was perhaps keener than his sense of opportunity. Before becoming the founder of McDonald’s, Ray was an astute salesman who valued personal development over anything else.

He kept himself motivated and never let the unfairness or randomness of life get the better of him. The Founder has a lot of learnings for a budding entrepreneur. Watching the film from that perspective will give you a newfound appreciation for it.

6. Margin Call (2011) – Diving into the shoes of an investment bank

Taking place over the course of a single night, Margin Call manifested a small fraction of the emotion felt inside an investment bank. The meltdown caused by the crisis actually happens before it comes out in public on a flash drive given to Peter Sullivan (Zachary Quinto) by a recently downsized Eric Dale. When Sullivan works his Ivy League magic and crunches the numbers, he discovers that the firm’s positions on its investments are over-leveraged. He immediately flags the Mayday alert to his boss Sam Rogers (Kevin Spacey), who then frenetically arranges a meeting of the board of directors. Jeremy Irons (as John Tuld) and Paul Bettany (Will Emerson) also star in the film.

Margin Call wields those defeating moments of tension and doomsday that the concerned financial professionals felt before the crisis came out. In a way, the helplessness and hopelessness of the situation is towering. Despite catching it in their systems, they literally could not do anything overnight. JC Chandor gives a compelling account of his directorial talent. He handles the subject matter really well and grasps at the teeth of the story very subtly and carefully so as not to overdramatize the impact.

Global Economic Recession of 2008: Films about Financial Crises

The biggest financial crisis of this millennium is the 2008 housing market collapse in America. Due to America’s pivotal and central position in the global financial system, the brunt of the collapse was felt by most of the economies. Its tremors affected the lives of people in every shape, manner, and form. If one looks at the broad history of other significant financial crises, the genealogy begins with the Great Depression of 1929. An instant classic that comes to mind is the Grapes of Wrath (1940), which manifested the effects of the Depression – dustbowl fields, empty houses, and wandering families looking for shelter. Splendour in the Grass (1961) is another film that positions itself in the backdrop of the crisis and explores the strength of love in overwhelming adversity.

Following this, the Suez Canal crisis of 1956 took shape, and how Britain invaded Egypt 50 years ago, making President Nasser a national hero and British prime Minister Anthony Eden a national disgrace. One cannot get past Suez: A Very British Crisis (2006) and Suez 1956 (1979) in this category. Even though the effects of the crisis did not majorly spiral into the economic fora, it severely affected trade and global peace. The impact of the Latin American crisis of the ‘90s is still felt in the affected continent. But we do not have many offerings on that subject. The 2008 crisis, however, has been widely covered by filmmakers keeping in focus different contexts. We have three different kinds of films covering the subject, and it is quite clear that they make the cut above the rest, given their extensive and theatrical rendition of the crisis.

7. Inside Job (2010) – A Hard-hitting Documentary-style take

The documentary style of storytelling has its own relevance and impact on audiences. When confronted with actual events that created a historical event, one often finds themselves overwhelmed and intrigued. Not more so than that event, which ended up ruining one’s life. The 2008 crisis touched the lives of many who lost everything owing to the bankruptcy of America’s leading, most secure financial institutions. Matt Damon narrates one of the most influential takes on the matter. The insights one gains from watching Inside Job are more or less holistic and detail-oriented.

Its depth of research and simplicity of writing is not intimidating for the common man. In fact, such is the organization of the snippets it attracts, even those who don’t care about money. Inside Job’s biggest strength is its objectivity. Despite such big guns involved, the makers seem averse to picking a side. Whatever happened is brought to the screen with the minimal color of dramatic impact. The streamlined storytelling is engaging and strongly responds to those who called it a conspiracy film.

8. The Big Short (2015) – The Story of a few premonitors who made millions in the crisis

Dr. Michael Burry bet against the entire world when he foresaw the opportunity to short one of the safest bets in the investing world – sub-prime housing mortgages. Real estate has been the doyen among sectors when it comes to building American wealth. It is synonymous with success and anticipation of life becoming easier for you. But in its most basic essence, it is the mirror image of the country’s marketing grandiosity. That ugly truth came out big time in the 2008 financial collapse. It threatened to destroy the lives of millions – and it sure did – but even more so, it exposed the corrupt haunches of the government and trusted financial institutions, many of which could never recover from the collapse.

Also, Read – All Adam Mckay Movies Ranked From Worst To Best

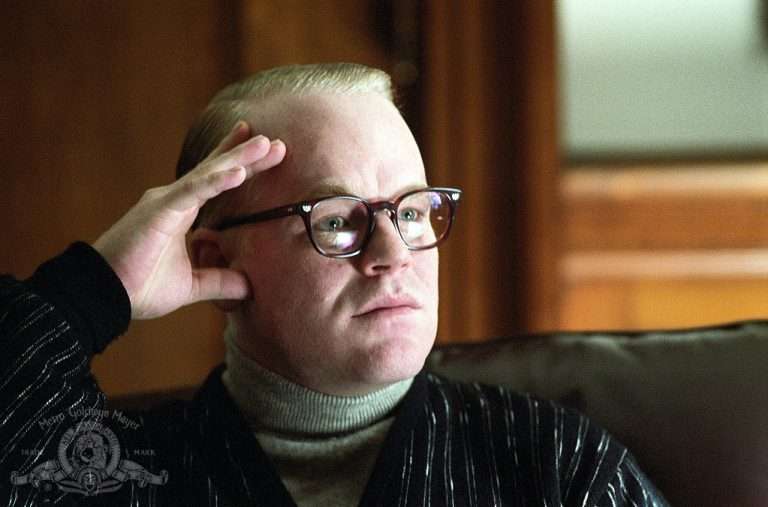

The Big Short is by far the most extensive and entertaining depiction of the crisis. With a star cast that has names like Steve Carell, Ryan Gosling, Christian Bale, and Brad Pitt, director Adam McKay bucks the trend to communicate information in a uniquely refreshing way. We actually do not see the effects of the collapse but how it gradually came to the attention of a few individuals who profited heavily due to it. It is intriguing how McKay makes the subject palatable without affecting its essence.

Capturing the Corruptive Allure of Money: Films about Financial Scams and Wall Street

Money is such an inflammable thing that once you get a taste for it, your hunger becomes insatiable with time. Spotting an opportunity to deceive other people and commit fraud has more to do with skill than luck. Major financial scams have the tendency to inspire outrage, imitation, and perennial learnings for the evolving financial system. There are a ton of instances of such debauchery in modern history. Famous names that come up in the discussion include Bernie Madoff, FTX and Theranos in recent memory, Enron, Jordan Belfort, and WorldCom, among others. Despite the vile nature of the acts themselves, the optimists can always find something admirable about the men behind these operations and the scale at which they run the play.

That is the most interesting aspect of such movies – getting to know the person who did it and how they did it. Leonardo DiCaprio and Robert De Niro are two of the most captivating actors in Hollywood. Their skill and stature are unmatched on most occasions, and it is the fitting reason why we have picked The Wolf of the Wall Street and The Wizard of Lies as our picks for this segment. The classic Wall Street featuring Gordon Gekko’s character is an undeniable poster boy for the chequered institution and had to make the cut here as well.

9. The Wolf of the Wall Street (2013) – The Big Con that Changed the SEC

There can be no list of finance-based movies without The Wolf of the Wall Street. It is just not possible. Martin Scorsese provides his viewers with an electrifying story filled with the madness of money. Jordan Belfort is now an urban legend – however underserved or deserved that tag may be – but it is the reality. Leonardo DiCaprio inhibited Belfort’s spirit in an intensely unique biographical turn. The actor has always shown glimpses of his comedic skills but took it up a notch as the notorious billionaire (erstwhile). Regarding scams, Belfort’s Stratton Oakmont ponzi scheme stands above all depictions.

The epic proportions of the embezzlement and Belfast’s blatant style is a repulsive yet remarkable chapter in our history books. There are all sorts of extremes that the movie oscillates between. Even then, it successfully finds a middle ground between emotion and exposition. However, one does not go into watching Wolf of the Wall Street for those parts. The incident also brought about revolutionary changes to SEC regulations, like those on insider trading and naked and over-the-counter derivatives.

10. The Wizard of Lies (2017) – an audacious facade even the best-believed

Bernie Madoff’s incredulous arrest led to nationwide shockwaves. The most remarkable supposition from the scam was that the great Warren Buffet got duped too! How about that? The dramatized version was released in 2017 and stars Robert De Niro in the central role. The movie does a fair job of establishing the rudimentary details of what happened, choosing not to comment definitively on what happened. We do not get to see the extent of the lives destroyed by Madoff’s ponzi scheme. There is only a ragged and gnawing feeling of some tectonic shifts in the financial world. The focus was on his family and the sons who were implicated without knowing the details. Madoff kept them in the dark to resist culpability when it all came out, but naturally, they were cornered too.

For years, the wizard of lies spun his web and made such a wild impression that none would go on to doubt him. He saw the opportunity and took it with both hands, lying straight to the faces of the sharpest minds in America, including Warren Buffet. In terms of value, this scam records the highest number. Wall Street bled red the day the news came out, suffering a similar fate when the housing market crashed. A lot of valuable lessons can be learned from the film about how to carefully read financial data and navigate the clutches of the apotheosis of human greed when one wants to make it big in life.